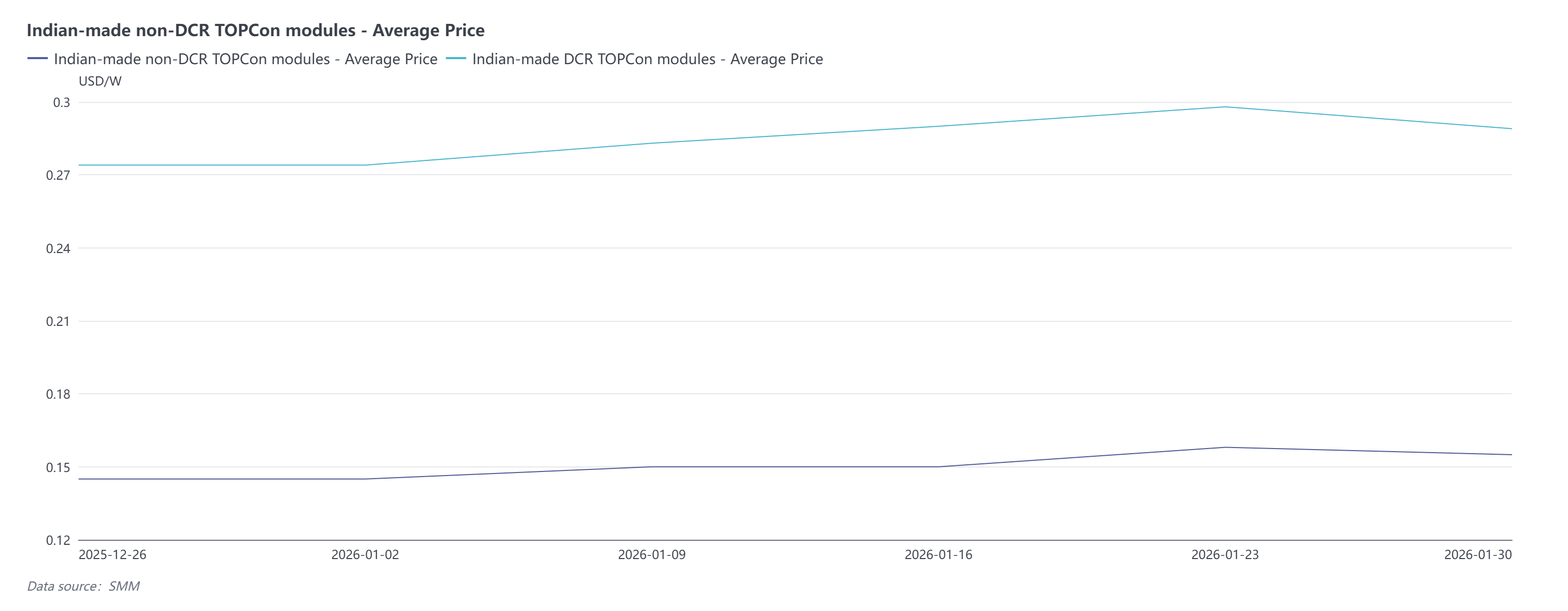

In early 2026, India's PV market exhibited a unique "dual-track" pricing characteristic for modules, driven by policy barriers and local capacity ramp-up. According to SMM, as of January 30, 2026, a significant price gap existed between DCR Topcon modules (meeting localization requirements) and non-DCR Topcon modules. This not only reflects structural contradictions in India's domestic solar manufacturing supply chain but also highlights the intense interplay between strong policy-driven forces and weak end-use demand.

The Indian government (Ministry of New and Renewable Energy, MNRE) mandates that PV projects participating in specific government subsidy schemes (such as the PM-KUSUM scheme, CPSU scheme, and residential rooftop PV program) must use domestically manufactured solar cells and modules. As a result, as of January 30, the price of DCR Topcon modules stood at USD 0.289/W, while non-DCR modules were priced at only USD 0.155/W, with the price spread nearly doubling. In recent trends, non-DCR module prices remained relatively stable, influenced by global supply chain costs (such as solar cell supply prices from China), hovering around the low range of USD 0.15/W. In contrast, DCR module prices experienced sharp fluctuations, reaching a historical high of USD 0.298/W in mid-to-late January. This price divergence underscores that the non-DCR market aligns more closely with the cost logic of global free trade, whereas the DCR market operates as a highly constrained seller's market driven by policy protection and tight supply-demand dynamics.

Policy side, the Indian government's strict enforcement of the Approved List of Models and Manufacturers (ALMM) and Domestic Content Requirement (DCR) policies are the core forces shaping the current market structure. These policies aim to support domestic manufacturing by restricting the use of imported products in government-funded projects, but they have led to severe supply-demand mismatch in the short term. Currently, India's local module assembly capacity is expanding rapidly, but the construction cycle for upstream cell capacity is longer, making compliant domestic cells a scarce resource in the market. According to public data, India's domestic solar cell capacity is approximately 30 GW per year, while module capacity is about 120 GW per year. This top-heavy supply structure forces DCR module producers to pay high premiums to secure domestic cells, directly driving up the production costs and end-user selling prices of DCR modules.

However, high prices inevitably dampen demand. Despite India's ambitious renewable energy installation targets, module costs nearing USD 0.3/W severely compress developers' yields, causing some price-sensitive utility-scale projects to adopt a wait-and-see approach or face delays. SMM data show that DCR module prices pulled back to USD 0.289/W on January 30 from USD 0.298/W the previous week. This correction was not due to improvements in upstream costs but rather a direct response to market resistance to high prices. Phased weakness in installation demand has increased inventory pressure on module producers, forcing some sellers to offer discounts at month-end to maintain cash flow.

Considering supply, demand, and cost factors, we maintain a cautious outlook on the future trajectory of India's module market. The current price decline is primarily driven by demand fluctuations due to weak installations, representing a market correction following the previous rapid price increases. Looking ahead, as bottlenecks in domestic cell capacity are unlikely to be fully resolved in the short term, the high premium for DCR modules is expected to persist for some time. However, with demand-side pressure, the momentum for further unilateral price increases has weakened. In the coming period, price fluctuations in India's module market are expected to gradually return to fundamentals, likely adjusting closely in line with changes in raw material costs such as wafers and silver paste. If raw material prices stabilize, the market may enter a period of rangebound fluctuation with cost-supported floors, awaiting further signals from end-use demand recovery and the release of local capacity.