SMM, August 31:

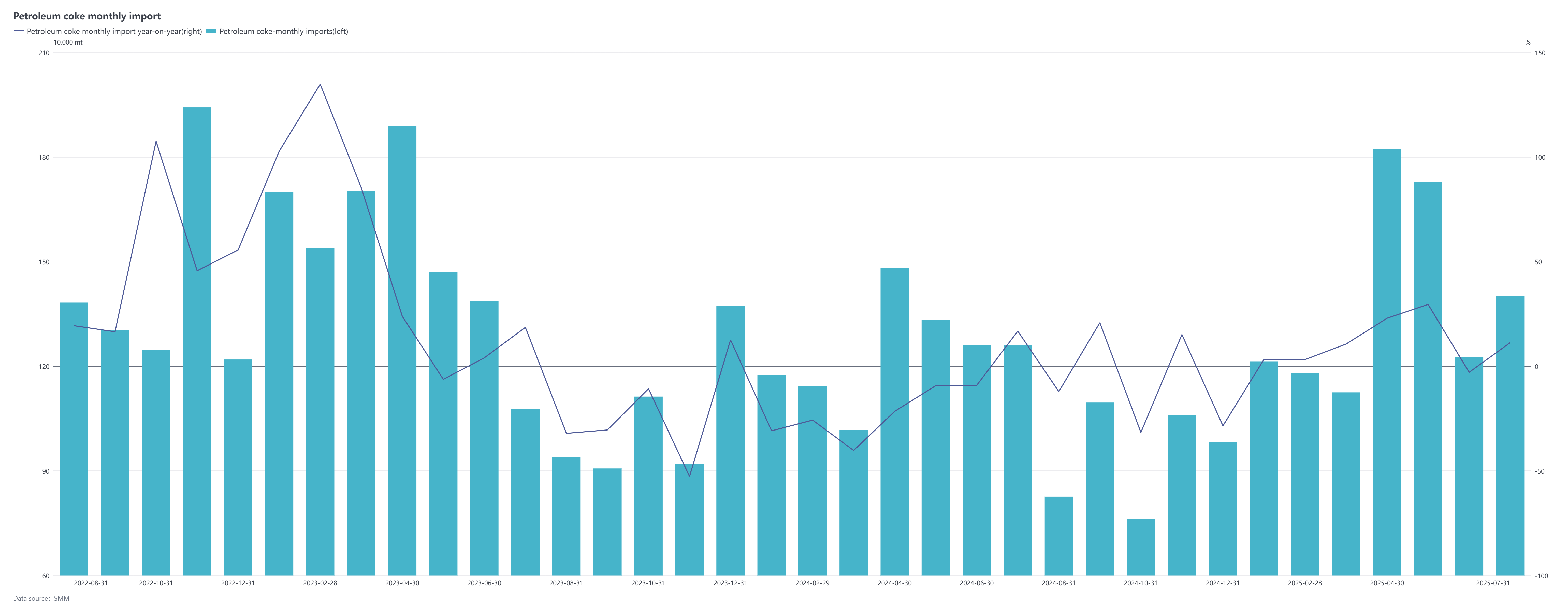

According to customs data, China imported 1.4025 million mt of petroleum coke in July 2025, up 14.44% MoM and 11.32% YoY. The estimated average import price was $202.7/mt, down 3.91% MoM but up 29.13% YoY. From January to July 2025, China’s cumulative petroleum coke imports totaled approximately 9.6986 million mt, up 11.84% YoY.

By country, China’s main petroleum coke import sources in July 2025 were Russia (319,600 mt, 23%), the US (254,000 mt, 18%), and Saudi Arabia (160,600 mt, 11%).

In terms of import prices, the average petroleum coke import price in July 2025 declined to $202.7/mt, down 3.91% MoM. Among the 21 source countries/regions, 16 showed continuous import volumes. Notably, imports from Kazakhstan saw a significant price increase of over $80/mt, while prices for imports from Azerbaijan, Germany, and Indonesia dropped sharply by over $130/mt.

Overall, July’s petroleum coke imports rose significantly MoM, with uncalcined petroleum coke (sulphur content < 3%) imports totaling 368,400 mt, up 38.09% MoM, reflecting growing domestic demand for low-sulphur petroleum coke. Since Q3, downstream anode material manufacturers have actively stockpiled, while domestic low-sulphur coke supply tightened. These dual factors boosted the low-sulphur coke market, coupled with just-in-time procurement by aluminum carbon producers, driving sustained market recovery. Domestic petroleum coke prices rose accordingly, port shipments improved markedly, and port inventories shifted to destocking. With robust domestic demand, traders showed moderate buying sentiment in the overseas market. However, considering high port inventory levels, SMM expects Q3 petroleum coke imports may decline slightly compared to Q2.