[SMM Daily Review of Hot-rolled Coil] Beware of Sentiment Fading, Futures Prices Peaked and Pulled Back

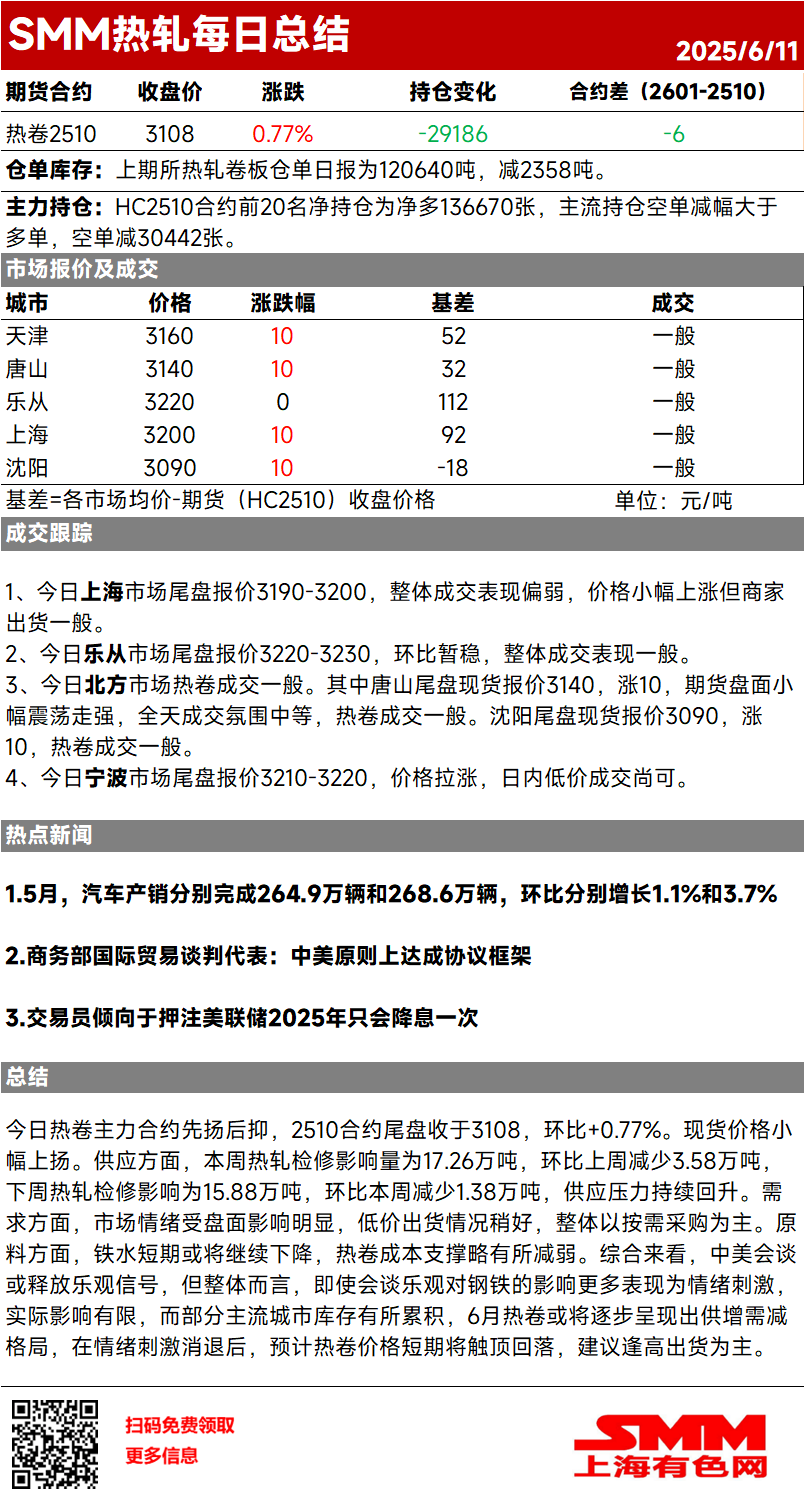

Today, the most-traded HRC futures contract first rose and then fell, with the 2510 contract closing at 3,108 at the end of the session, up 0.77% MoM. Spot prices increased slightly. In terms of supply, the impact from HRC maintenance this week was 172,600 mt, a decrease of 35,800 mt WoW. Next week, the impact from HRC maintenance is expected to be 158,800 mt, a decrease of 13,800 mt WoW, indicating a continued rebound in supply pressure. On the demand side, market sentiment was significantly influenced by the futures market, with slightly better sales at lower prices. Overall, purchasing was mainly as needed. In terms of raw materials, pig iron production may continue to decline in the short term, slightly weakening the cost support for HRC. Overall, the China-US talks may release optimistic signals. However, on the whole, even if the talks are optimistic, their impact on steel will be more about stimulating sentiment, with limited actual effects. Meanwhile, inventory has accumulated in some mainstream cities. In June, HRC may gradually show a pattern of increasing supply and decreasing demand. After the sentiment-driven rally fades, it is expected that HRC prices will peak and pull back in the short term. It is recommended to focus on selling at highs.

Today, the most-traded HRC contract first rose and then fell, with the 2510 contract closing at 3108 in the final session, up 0.77% MoM. Spot prices increased slightly. In terms of supply, the impact from HRC maintenance this week was 172,600 mt, a decrease of 35,800 mt WoW. Next week, the impact from HRC maintenance is expected to be 158,800 mt, a decrease of 13,800 mt WoW, indicating a continued rebound in supply pressure. On the demand side, market sentiment was significantly influenced by the futures market, with slightly better sales at lower prices. Overall, purchasing as needed was the main strategy. In terms of raw materials, pig iron production may continue to decline in the short term, slightly weakening the cost support for HRC. Overall, while the China-US talks may release optimistic signals, the overall impact on steel is more likely to be sentiment-driven, with limited practical effects. Additionally, inventory has accumulated in some mainstream cities. In June, HRC may gradually exhibit a pattern of increasing supply and decreasing demand. After the sentiment-driven rally fades, it is expected that HRC prices will peak and pull back in the short term. It is recommended to focus on selling at highs.